Bybit Review: is this really the Bitmex Killer?

Bybit is giving Bitmex a run for its money with a very polished futures market

Bybit Rating

Bybit is quickly making a name for itself amongst bitcoin futures traders. A gorgeous UI and lightning fast trades make it our top pick.

- Trust 9.5

- Design 9.8

- Fees 9.8

- Markets 9.5

- Support 9.7

I love trading bitcoin futures. Nothing is more exciting than predicting a 10% move in bitcoin while using leverage. When it works, it can be extremely rewarding. Which honestly is the issue many traders have reported with Bitmex. During times of volatility the system puts up an overload error, and that's it, you're screwed and cannot trade. No good.

When you’re trading the most volatile asset known to mankind the last thing you want to see is your exchange not working. About a year ago there wasn’t many solid options as an alternative to Bitmex, but that has certainly changed in 2019. Enter Bybit.

Official Site: Bybit (https://www.bybit.com) <– $60 signup BONUS via this link

The first thing you'll notice about Bybit is that it looks very similar to Bitmex.

Bybit is the new boy on the block and they've laid a solid foundation with plenty of time and effort spent on a truly advanced trading engine. I also like that Bybit is legally structured in the British Virgin Islands, with their headquarters based in Singapore, a well known fintech friendly capital. That said, most new exchanges suffer from liquidity issues but Bybit has been making leaps and bounds in user signups since they launched in April 2019. They've been really on a roll.

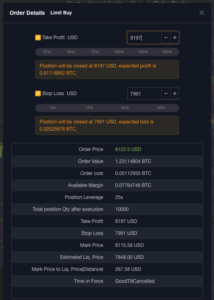

The UI is familiar but there are some subtle differences. One thing I like is they add fields for take profit and stop loss right from the order screen. Since you should be doing this for every single trade anyways, I really like that it's there.

You'll see the familiar Bitmex like margin slider, a TradingView chart, an order book, and the expected order types: limit, margin, take profit, stops, and even a trailing stop feature. Perfect.

No trollbox! Really glad to see it, chat really has no place in my futures trading client, I have Telegram and Discord for that.

How does it work? What coins can we trade?

Bybit is a futures market. You are placing trades (bets) on whether a specific cryptocurrency goes up or down. The contract you're using has no expiry, thus it is called a perpetual contract. If you make a winning trade you will gain the underlying coin, and if you make a bad trade you will lose it.

On Bybit you can trade BTC, ETH, XRP and EOS and what's really unique about Bybit is that in order to trade each of these coins you must actually deposit that coin on the exchange. So this is very different from Bitmex and Deribit who only accept BTC.

Leverage

On Bybit you can trade 1x (no leverage) or as high as 100x (100 times your trade value). Leverage is complex and dangerous, as you can get liquidated of all your currency if your leverage is too high. Always keep an eye on your Liquidation Price when using leverage!

Leverage is powerful, it allows you to bet with a much larger crypto stack than you actually have. Used properly is can be very rewarding. Of course, in order to use leverage you must incur fees.

Fees

Guess what? The fees are identical to Bitmex, which is honestly its most redeeming quality. If you always limit in and limit out, you can get paid to trade here. See below:

Takers (market order) pay 0.075% on each trade, Makers (limit order) receive 0.025% on each trade.

For funding Bybit works the same as Bitmex. Funding occurs every 8 hours at 16:00 UTC, 00:00 UTC and 08:00 UTC. You will only pay / receive funding if you hold a position at one of these times.

Bybit appears to scale (so far)

This is all great but how does the exchange handle itself under load? Look, I'm not naive, I know Bybit doesn't have even a fraction of Bitmex's daily volume yet, but the truth is they are growing very fast. Liquidity is growing week on week and it's very usable for trading aside from maybe the large whales out there.

That said, under load and in times of absolute volatility, Bybit didn't skip a beat. Smooth as butter. And the reason is they actually spent a great deal of time and money on building a very powerful matching engine. According to Bybit they've tested up to 100,000 tps (transactions per second). This is quite remarkable!

Bybit Video Review

See below for a detailed trading tutorial and review for Bybit.

Official Site: Bybit (https://www.bybit.com) <– $60 signup BONUS via this link

Pros

- Trading Bonuses?! Bybit is running a promotion that gives you $10 in FREE margin as a trading bonus, simply by signing up. Receive a $50 bonus after depositing a min of 0.2 BTC OR 6 ETH. WOW!

- Bybit is incorporated in the British Virgin Islands, with headquarters in Singapore.

- Gorgeous and recognizable UI with an adjustable trading GUI. It’s Bitmex, without the system overload issues.

- You can margin trade: BTC, ETH, XRP, and EOS in their respective coin.

- System encourages stop loss / take profit measures at the time of order.

- Lightning fast trades — With their advanced matching engine they claim capabilities for 100k tps (transactions per second).

- No overload issues or errors even under load.

- Less flash crashes like you often see on Bitmex.

- Same fees structure: Takers (market order) pay 0.075% on each trade, Makers (limit order) receive 0.025% on each trade.

- In late Sept 2019 they released adjustable drag and drop orders. Love this feature! Read their blog post about this.

- Awesome support — My questions were answered quickly and courteously.

- Bybit has a robust trading API.

- Website works great on mobile.

- Very limited KYC.

Cons

- Needs better order book depth, I like to zoom out and see the orders accumulating far away from price.

- Allowing a user to visually see order sizes (walls) on the book rather than accumulated totals would be nice – I noticed the mobile version of the website does this so maybe I missed it.

- Restricted for United States of America or Québec (Canada), and Singapore.

No movable limit/stop orders right within the chart like Bitmex.